In this public sector accounting guide, we are going to consider the introduction to public sector accounting in Malaysia.

Introduction to Public Sector Accounting in Malaysia

The public sector, which is the part of an economic system that countries and governments use to trade and distribute resources, is generally a section controlled by local, state, or national governments. It also includes national, provincial, territorial, and local governments.

It can refer to the state, province, territorial, or local government (e.g., the government of a city or town and other related entities (e.g., agencies, boards, and commissions, as well as wellasa enterprises).

These sections can be funded entirely by the state for non-profit services or partly by the state for services that are profitable.

Overview of the Malaysian Public Sector Accounting Standards (“MPSAS”)

Malaysian Public Sector Accounting Standards Overview (MPSAS)

Malaysia’s Accountant General’s Department (“AGD”) has issued the Malaysian Public Sector Accounting Standards, or MPSAS, as a financial reporting framework.

Read also: INTERNATIONAL PUBLIC SECTOR ACCOUNTING STANDARDS (IPSAS)

We’ll give an overview of MPSAS in this article.

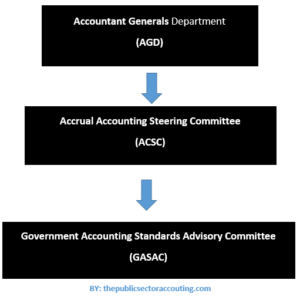

The MPSAS AGD of Malaysia has established two groups to supervise and manage the development, issuance, and implementation of MPSAS: the Government Accounting Standards Advisory Committee (“GASAC”) and the Accrual Accounting Steering Committee (“ACSC”).

Governance structure of MPSAS issuance

(“GASAC”), the Government Accounting Standards Advisory Committee.

The GASAC committee is in charge of deliberating on draft MPSAS standards. The state treasury, ministry of finance, Auditor General’s Office, institutions of higher learning, Malaysian Institute of Accountants (“MIA”), Malaysian Accounting Standards Board (“MASB”), and accounting bodies such as the Association of Chartered Certified Accountants (“ACCA”), Malaysian Institute of Certified Public Accountants (“MICPA”), and CPA Australia are all represented on GASAC.

The Accrual Accounting Steering Committee (ACSC)

ACSC is a committee that is one level above GASAC. The ACSC considers, accepts, and endorses GASAC’s recommendations on proposed MPSAS standards.

Also Find Out: Advantages and Disadvantages of cash basis in public sector accounting

The Chairman is Malaysia’s Accountant General, while the members are the AGD’s senior directors and the Chief Accountants of Federal Ministries.

The MPSAS development process

MASB produces financial reporting frameworks that are based on the Worldwide Accounting Standards Board’s (“IASB”) international financial reporting standards.

1.IFRS (International Financial Reporting Standards) and

2. International Financial Reporting Standards for Small and Medium Enterprises (“IFRS for SMEs”).

Similarly, AGD adapts an international financial reporting framework to create the MPSAS financial reporting framework.

The International Public Sector Accounting Standards (“IPSAS”) are the foundation of MPSAS. IPSAS is issued by the International Public Sector Accounting Standards Board (“IPSASB”), an independent standard-setting organization within IFAC.

IPSASB standards are being considered by GASAC for adoption in Malaysia. MPSAS standards are not identical to or word-for-word equivalents of IPSAS. For local adoption, MPSAS modifies or replaces certain IPSAS requirements.

Nonetheless, unless there is a serious public sector issue or local legislation that warrants a divergence from IPSAS, AGD takes the position of maintaining, to a large extent, the accounting requirements and original text of IPSAS.

Any departure, on the other hand, will only be made after consultation with diverse stakeholders.

The comparison of MPSAS to its IPSAS equivalent is usually included on the last page of the MPSAS standard, along with an explanation or justification for the difference. So that’s how and where you’ll be able to tell the differences apart.

Who are the Users of Malaysian Public Sector Accounting Standards (“MPSAS”)?

We explain that MPSAS is used by public sector firms other than government business enterprises (“GBEs”) in Accounting 101: Financial Reporting Frameworks in Malaysia. In reality, we explained in that post that GBEs are entities that have the following characteristics:

1. a legal entity with the authority to contract in its own name.

2. It has also been given financial and operational authorization to operate a firm.

3. It sells goods and services to other entities at a profit or at full cost recovery in the normal course of business.

4. It is not dependant on ongoing government assistance to remain a going concern (other than arm’s length purchases of outputs).

5. Finally, it is governed by a government agency.

The above features are based on a previous GBE definition. IPSAS, on the other hand, takes the place of the GBE term. Instead, the term “public sector entities” is defined and used by IPSAS.

According to IPSAS, public sector entities are defined as those that meet all of the following criteria:

1. For starters, public-sector entities are in charge of providing services to the general public and/or redistributing income and wealth.

2. Second, public sector entities fund their activities primarily through taxes and/or transfers from other levels of government, social contributions, debt, or fees, either directly or indirectly.

Finally, the basic goal of public-sector organizations is not to produce money.

As a result, entities that do not meet the above conditions are not permitted to use IPSAS. However, MPSAS has not yet taken up this modification.

The following is a list of MPSAS standards that have been published to date.

The AGD has issued 35 MPSAS standards as of the writing of this article. Three of the 35 standards have been replaced by the more modern MPSAS standards. As a result, the following MPSAS standards are still in effect, except the obsolete standards:

1. Malaysian Public Sector Accounting Standard (MPSAS) 1 Presentation Of Financial Statements

2. Malaysian Public Sector Accounting Standard (MPSAS) 2 Cash Flow Statements

3. Malaysian Public Sector Accounting Standard (MPSAS) 3 Accounting Policies, Changes In Accounting Estimates And Errors

4. Malaysian Public Sector Accounting Standard (MPSAS) 4 The Effect Of Changes In Foreign Exchange Rates

5. Malaysian Public Sector Accounting Standard (MPSAS) 5 Borrowing Costs

6. Malaysian Public Sector Accounting Standard (MPSAS) 9 Revenue From Exchange Transactions

7. Malaysian Public Sector Accounting Standard (MPSAS) 11 Construction Contracts

8. Malaysian Public Sector Accounting Standard (MPSAS) 12 Inventories

9. Malaysian Public Sector Accounting Standard (MPSAS) 13 Leases

10. Malaysian Public Sector Accounting Standard (MPSAS) 14 Events After The Reporting Date

11. Malaysian Public Sector Accounting Standard (MPSAS) 16 Investment Property

12. Malaysian Public Sector Accounting Standard (MPSAS) 17 Property, Plant And Equipment

13. Malaysian Public Sector Accounting Standard (MPSAS) 19 Provisions, Contingent Liabilities And Contingent Assets

14. Malaysian Public Sector Accounting Standard (MPSAS) 20 Related Party Disclosures

15. Malaysian Public Sector Accounting Standard (MPSAS) 21 Impairment Of Non-Cash-Generating Assets

16. Malaysian Public Sector Accounting Standard (MPSAS) 22 Disclosure Of Financial Information

17. Malaysian Public Sector Accounting Standard (MPSAS) 23 Revenue From Non-Exchange Transactions (Taxes & Transfers)

18. Malaysian Public Sector Accounting Standard (MPSAS) 24 Presentation Of Budget Information In Financial Statements

19. Malaysian Public Sector Accounting Standard (MPSAS) 25 Employee Benefits

20. Malaysian Public Sector Accounting Standard (MPSAS) 26 Impairment Of Cash-Generating Assets

21. Malaysian Public Sector Accounting Standard (MPSAS) 27 Agriculture

22. Malaysian Public Sector Accounting Standard (MPSAS) 28 Financial Instruments: Presentation

23. Malaysian Public Sector Accounting Standard (MPSAS) 29 Financial Instruments: Recognition And Measurement

24. Malaysian Public Sector Accounting Standard (MPSAS) 30 Financial Instruments: Disclosure

25. Malaysian Public Sector Accounting Standard (MPSAS) 31 Intangible Assets

26. Malaysian Public Sector Accounting Standard (MPSAS) 32 Service Concession Arrangements: Grantor

27. Malaysian Public Sector Accounting Standard (MPSAS) 33 First-Time Adoption Of Accrual Basis Malaysian Public Sector Accounting Standard (MPSAS)S

28. Malaysian Public Sector Accounting Standard (MPSAS) 34 Separate Financial Statements

29. Malaysian Public Sector Accounting Standard (MPSAS) 35 Consolidated Financial Statements

30. Malaysian Public Sector Accounting Standard (MPSAS) 36 Investments In Associates And Joint Ventures

31. Malaysian Public Sector Accounting Standard (MPSAS) 37 Joint Arrangements

32. Malaysian Public Sector Accounting Standard (MPSAS) 38 Disclosure Of Interest In Other Entities

For reference, the Malaysian Public Sector Accounting Standards (MPSAS) are published on AGD’s website at Malaysian Public Sector Accounting Standards (MPSAS).

Some of the standards listed above, such as MPSAS 21, MPSAS 23, and MPSAS 24, are only applicable to the public sector.

This is because the public sector’s unique nature necessitates specific standards to handle issues that aren’t applicable or available in the private sector.

The following is a list of IPSAS standards that have yet to be adopted.

If you’re asking if there are any more IPSASB standards that have yet to be approved by AGD, the answer is yes. The IPSAS standards that have yet to be implemented are listed below:

- IPSAS 18 Segment Reporting

- IPSAS 39 Employee Benefits

- IPSAS 40 Public Sector Combinations

- IPSAS 41 Financial Instruments

- IPSAS 42 Social Benefits

Conclusion

We hope you now have a good understanding of MPSAS. In forthcoming installments, we’ll go over the differences between MPSAS, MPERS, and MFRS in more detail.

Meanwhile, take a look at the other articles in the Financial Accounting department.