LOCAL GOVERNMENT BUDGET AND FINANCIAL REPORTING SYSTEMS

Structures and Levels of Government of Local Government

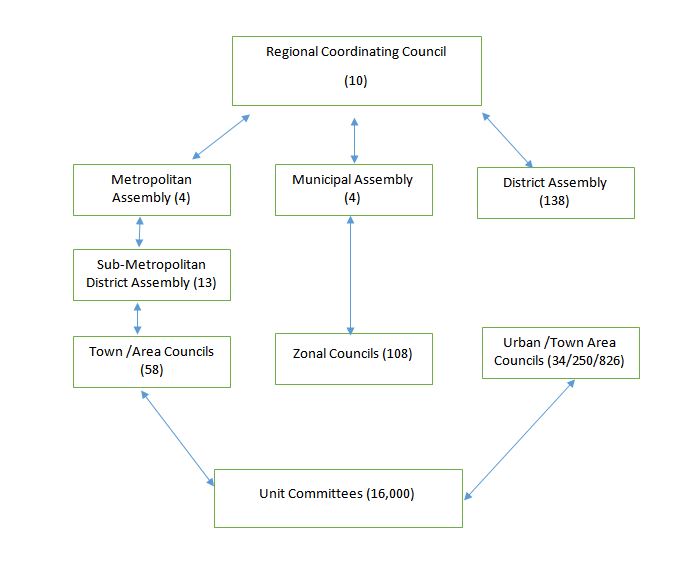

Ghana has five levels of government at the local level. They are made up of

- Regional Coordinating Council

- Four-tier Metropolitan Assembly

- Three-tier Municipal / District Assembly

- Urban/town/area/zonal Councils

READ ALSO:

what is fund accounting in public sector

What is Public sector accounting

Below is a diagrammatic structure of government levels:

LOCAL GOVERNMENT BUDGET AND FINANCIAL REPORTING SYSTEMS

The Regional Coordination Council

This the apex organization at the local level. It is responsible for regional security, coordination, monitoring and evaluation of all government affairs.

Metropolitan/Municipal/ District Assemblies

They are the highest political authorities at the district level. They are the main focus of central governments political, social and economic activates at the district level. Metropolitan/Municipal/District Assemblies have legislative, judicial and executive authority at the local level.

Section 10(3) of Act 462, Local Government Act 1993 defines the functions of Metropolitan/Municipal/District Assemblies as; having responsibility

- For the overall development of the district and shall ensure the preparation and submission through the Regional Coordination Council for approval of the development plan to the NDPC and budget to Minister of Finance for the district

- To formulate and execute the plan, programs and strategies for the effective mobilization of the resources necessary for the overall development of the district:

- To promote and support productive activity and social development in the district and remove any obstacles to initiative and development

- To initiate programs for the development of basic infrastructure and provide municipal works and services in the district

- For the development, improvement and management of human settlements and the environment in the district;

- In cooperation with appropriate national and local security agencies, be responsible for the maintenance of security and public safety in the district;

- To ensure ready access to the courts and public tribunals in the district for the promotion of justice;

- To initiate sponsor or carry out such studies as may be necessary for the discharge of any of the functions conferred by the Act or any other enactment

- To perform such other functions as may be provided under any other enactment.

It is understood that the political authority of a country’s central government extends over the entire territory of the country. The central government can impose taxes on all resident institutional units and on nonresident units engaged in economic activates within the country.

READ ALSO:

Sources of Government Revenue in Ghana

Accounting for government stores, Public sector accounting

The central government typically is responsible for providing collective services for the benefit of the community as a whole, such as national defence, relations with other countries, public order and safety, and the efficient operation of the social and economic system of the country.

In addition, it may incur expenses on the provision of services, such as education or health, primarily for the benefit of individual citizens, and it may make transfers to other institutional units, including other levels of government.

However, the legislative, judicial, and executive authority of local government units is restricted to geographic areas distinguished for administrative and political purposes.

The scope of local government units is restricted to geographic areas distinguished for administrative and political purposes. The scope of local government authority is generally much less than that of the central government, and the government may or may not be entitled to levy taxes on institutional units or economic activities taking place in their areas.

They are often heavily dependent on grants from the central government, and they may also act as agents of the central government to some extent. They are entitled to own assets, raise funds and incur liabilities by borrowing on their own account.

They must also have some discretion over how such funds are spent, and they should be able to appoint their own officers independently of external administrative control.

Some of the most typical functions of local governments include financing:

- Educational establishments in which a user’s feed are small in relation to the main costs borne by the local government

- Dressing stations and social welfare establishments such as kindergartens, nurseries.

- Public sanitation and related entities, such as water purification systems and plants, refuse collection and disposal agencies, cemeteries and

- Culture, leisure, and sports facilities, such as music halls libraries, parks and open spaces.

Financial relations between central and local government. There are a number of legal rules and regulations which govern the financial relations of the central government with local authorities. One set of rules involve financial arrangements for raising funds. They include

- The tapping of own revenues (Act 245 and 252 of 1992) constitution and section 34, Part VII, VIII, IX and X of Act 462.

- Institution of ceding revenue Sixth schedule of Act 462;

- Establishment of District Assemblies common fund (Act 455);

- Other specialized funding arrangements including stool lands royalty’s timber, royalties, minerals development funding, revenue form lotto operators and special payments by agencies and compiles operating in the areas of jurisdiction District Assemblies.

- Recurrent expenditure transfers: a second set of rules are meant to ensure transparency: accountability and efficiency in the management of finances of local authorities:

- The merger of central and local government treasuries at the district level into one district finance office;

- Decentralization of the award and payments for contracts up to limits set by the ministry for finance;

- Establishment of district tender boards under L.I 1606 (1995).

- ACT 462 section 91 of the power of the minister for local government to give financial instructions to district assemblies;

- Section 91(1) power of the minister for the local government after consultation of Act 462 with the minister responsible for finance, to issue written instructions, not inconsistent with any of the provisions of the better control and efficient management of the finances of district assemblies,

- Section 93(1) power of the minister of local government to authorize the inspection of books, accounts and records of district assemblies

- Section 93(2) establishes for the purposes of section 93(1) an inspectorate of act 462 division of the ministry of local government;

- Act 462 pf section 93(3) offences for willful obstruction for inspectorate staff;

- Section 120 internal audit, external audit and recovery of sums to 123 of Act 462 certified due by external auditors;

- Act 92 (1) every district assembly shall, before the end of each financial 462 years, submit to the regional coordinating council a detailed budget for the district stating the revenue and expenditure of the district for ensuring year.

- the regional coordination council shall collate and coordinate the budget of the districts in the region and shall submit the total budget to the minister responsible for finance and submit copies to the minister and the National Development Planning Committee.

- the budget for a district shall include the aggregate revenue and expenditure of all departments and organizations under the District Assembly and the District Coordinating Directorate, including the annual development plans and programs of the departments and organization under the assembly.

(1). Act 93 (1) A person authorized in writing for the purpose by the Minister shall at all reasonable times have access to, and be entitled to inspect all books, accounts and records of any District Assembly and may advise the assembly on them and submit reports to the Minister and the Regional Coordinating council in connection with them.

(2). For the purpose of subsection (1) of this section, there may be established a division of the Ministry with staff under terms and conditions as the public Services commission.

(3). A person who willfully obstructs another person in the discharge of his duties under subsection (1) of this section commits an offence and is liable on conviction to a fine not exceeding gh100,000.00 or for a term of imprisonment not exceeding three months or both; and in case of a continuing offence to a further fine not exceeding GH 1,000.00 for each day on which the offence continues.

- i. a. FM Part VII Section 77: every District Assembly should produce annual accounts and statements.

- Act 462 Section 125: Every District Assembly shall publish his reports on Public accounts and present them to the speaker to be laid before parliament;

- Act 582 Section 23: The Auditor general shall publish his reports on public accounts and present them to the speaker to be laid before parliament.

Since the District Assemblies Common Fund forms a very substantial proportion of the revenue of the local authority, it may be necessary to produce the current (2009) guidelines for the utilization of the fund:

Leave a comment