The consolidated Fund in Ghana – What is the difference between consolidated fund and contingency fund?

Summary of Contents

What is the Consolidated Fund

The consolidated fund is a fund established by law (FAA) into which are paid all revenue and any other monies (receipts and trust monies raised or received on behalf of the government, and from which all lawful disbursements are made on behalf of the government. It was established to serve as a central mechanism for the control of public finances.

Benefits of Consolidated Fund in Ghana

It enables the government to

- Know its financial position (cash balance) at any point in time.

- Know its total revenue (tax) and receipts (non-tax revenue) at a particular time

- Take decisions on expenditure and lending, as these activities diminish the liquid reserves, and

- Take decisions on borrowing. Government borrowing increases the liquid reserves, making money available for spending, but increase annual expenditure on interest charges. Liquid reserves have to be built up to meet redemption of government debt.

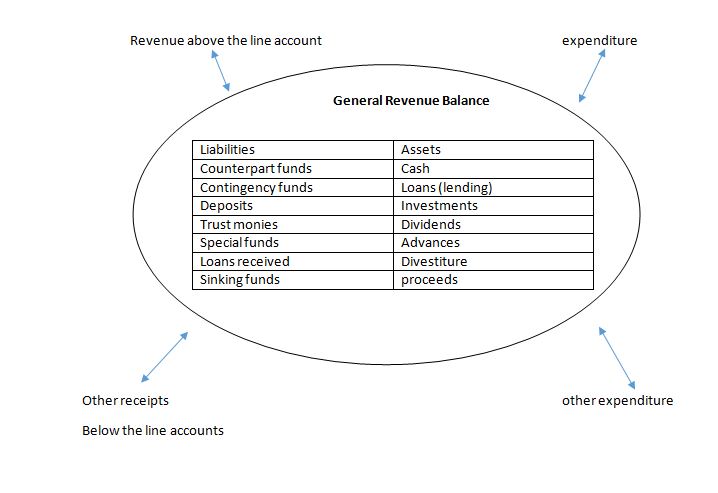

Inputs

There are two main types of inputs into the consolidated fund.

- Revenue

- Other receipts

READ ALSO: Accounting for government stores, Public sector accounting

Revenue

These may be direct or indirect taxes, eg personal income tax, company tax, customs duty, excise duty and value-added tax.

other receipts

These consist of government borrowings, repayment of government loans and advances, sale of government securities, divestiture and dividend from investments, counterpart funds, sinking fund etc.

Components of the Consolidated fund in Ghana

- Above the line accounts

- General revenue balance

- Below the line accounts

- Reserves

The consolidated Fund in Ghana

This can also be refer to the consolidated fund of Ghana, but it has similar relations to other African countries like Nigeria, Uganda and also South Africa.

Revenue above the line accounts

Above the line accounts

These relate to transactions forming part of the government’s annual budget for the provision of services for both recurrent and capital expenditure. These accounts have a limited lifespan, that is they lapse at the end of every year.

General revenue balance

The net balance of all the above the line accounts is known as the general balance. It is made up of unspent revenue, that is, where expenditure has not yet been committed. At the end of each financial year, this balance is transferred below the line to reserves.

Below the line account

These are subsidiary accounts that related to all other transactions and balances of the consolidated fund – assets, liabilities and reserves. These accounts do not lapse but continue from year to year.

CHECKOUT: Fund Accounting in the public sector accounting

Reserves

These are cash balances held by the government either in local or foreign banks to meet import bills and other commitments.

Outputs

- Expenditure (payment)

- Other expenditure (other payments)

Expenditure

This could either be cash payments (recurrent expenditure) or investment expenditure.

Cash payment (recurrent expenditure)

These are disbursements and expenses made by the government to meet its obligations, commitments, programmers and provision of services. Examples are administrative expenses and service expenses.

Investment expenditure

This involves huge capital outlays by the government sometimes spanning several years, as is the case, in the construction of roads, buildings etc. another investment expenditure involves the purchase of securities and shares in businesses, advances and loans for jobs creation, and improvement of governments fixed assets and infrastructure development.

Special fund

- Trust funds

- Sinking funds

- Counterpart funds

- Contingency funds

- Revolving funds

Trust fund

A trust fund is a special fund set up using a donation or bequest from a private person or persons for a public objective and for which the government of Ghana is nominated to act as trustee.

That means the government may use the money in accordance with terms of the trust deed, legally belong to the government (FAR 81).

The principal sum (that is, the amount donated or bequeathed) is invested in securities in accordance with the rules laid down in section 81-83 of the financial administration regulations 2004, any interest derived and any profits or losses on sales of securities belong to the trust fund,

Trust funds allow the government to finance projects without withdrawing monies from the consolidated fund. The fact that the money may be invested means that the government may make full use of the donations or bequest. It should be protected from the effect of inflation and the value derived from the fund may even be greeted than its original value due to interest received.

Sinking funds

A sinking fund is a special fund created for the repayment of a loan at some time in the future. Amounts are paid into the sinking fund each year are calculated so that they, plus interest earned on them, will be sufficient to repay the loan on the due date.

The creation of a sinking fund requires the authorization of the government. The controller and accountant general administers such funds and makes the annual payment into the fund. The contributions made to sinking funds are invested and the interest accrues to the funds.

If the amount of sinking fund is less than the amount needed to repay the loan, the deficit is made up of the consolidated fund. Similarly, if the amount of sinking fund is more than the required the surplus is transferred into the consolidated fund.

READ ALSO: Sources of Government Revenue in Ghana

The sinking fund enables the government to minimize the effect of loan repayment on the consolidated fund by withdrawing monies annually, not only on the repayment date. Also, the fact that the funds are invested means that the amount taken from the consolidated fund is less than the amount to be repaid. The difference is made up by the interest earned.

Counterpart funds

Donors sometimes prefer to finance projects by giving goods rather than cash. In these cases, the government is given the right to see the goods and use the revenue raised to finance the specified project.

The revenue raised from the sales of goods from the different project is accounted for in separate counterpart funds, created y legislation setting out how the fund should be operated.

Using counterpart funds enables the government to obtain finance from organizations that may not have surplus cash but do have surplus goods. The government is free to decide how to use the goods and therefore has some control over when cash is realized and by seating the sales price, how much cash is raised.

However, if the goods supplied are inappropriate or difficult to sell, the government may not receive the full benefit to the donation.

Contingency funds

The contingency fund is used to help the government cope with disasters and other unexpected events that require public money but have not been specifically included in the budget.

The fund must be created by an act of parliament and only monies voted for the purpose are to be paid into it.

Payments may be made into for the fund with the authorization of the finance committee in parliament. The authorization will be given when the committee is satisfied that there has arisen an urgent or unforeseen need for expenditure for which no other provision has been made.

When any advance is made out of the contingency fund a supplementary estimated should be presented to parliament so that the fund may be reimbursed from the consolidated fund. Reimbursement could also come from any special fund (such as a trust or counterpart fund) that is subsequently created to address the need for which the advance was made.

For example, a CSM immunization programme may have to be carried out at short notice to prevent an epidemic. If no allowance has been made for such a programme in the budget, the expenditure could be made from the contingency fund, given the necessary authorization.

However, it may be that the World Health Organization offers to fund the program after it has started. A trust fund world then is set up for the cash received from the WHO and repayment to the contingency fund would be made from it.

YOU MAY MISS: REGULATORY FRAMEWORK OF PUBLIC SECTOR ACCOUNTING IN GHANA

The contingency fund enables the government to make payments at short notice to meet urgent needs without disrupting its normal business by drawing on the consolidated fund.

Revolving fund

This fund is used to enable public sector organizations to purchase items to be sold to the public. The revenue raised is paid back into the fund, hence the term revolving. An example is the purchase of textbooks. Schools obtain monies from the revolving fund and use it to purchase textbooks.

These are then sold to pupils and the revenue raised is repaid to the consolidated fund in Ghana.

Public money is voted to the fund each year by parliament.

FAQs

Consolidated Fund

The consolidated fund is a fund established by law (FAA) into which are paid all revenue and any other monies (receipts and trust monies raised or received on behalf of the government, and from which all lawful disbursements are made on behalf of the government. It was established to serve as a central mechanism for the control of public finances.

Contingency funds

The contingency fund is used to help the government cope with disasters and other unexpected events that require public money but have not been specifically included in the budget.

The fund must be created by an act of parliament and only monies voted for the purpose are to be paid into it.

Payments may be made into for the fund with the authorization of the finance committee in parliament. The authorization will be given when the committee is satisfied that there has arisen an urgent or unforeseen need for expenditure for which no other provision has been made.

Consolidated Fund

The consolidated fund is a fund established by law (FAA) into which are paid all revenue and any other monies (receipts and trust monies raised or received on behalf of the government, and from which all lawful disbursements are made on behalf of the government. It was established to serve as a central mechanism for the control of public finances.

Contingency funds

The contingency fund is used to help the government cope with disasters and other unexpected events that require public money but have not been specifically included in the budget.

The fund must be created by an act of parliament and only monies voted for the purpose are to be paid into it.

Payments may be made into for the fund with the authorization of the finance committee in parliament. The authorization will be given when the committee is satisfied that there has arisen an urgent or unforeseen need for expenditure for which no other provision has been made.

When any advance is made out of the contingency fund a supplementary estimated should be presented to parliament so that the fund may be reimbursed from the consolidated fund. Reimbursement could also come from any special fund (such as a trust or counterpart fund) that is subsequently created to address the need for which the advance was made.

For example, a CSM immunization programme may have to be carried out at short notice to prevent an epidemic. If no allowance has been made for such a programme in the budget, the expenditure could be made from the contingency fund, given the necessary authorization.

However, it may be that the World Health Organization offers to fund the program after it has started. A trust fund world then is set up for the cash received from the WHO and repayment to the contingency fund would be made from it.

The contingency fund enables the government to make payments at short notice to meet urgent needs without disrupting its normal business by drawing on the consolidated fund.

Leave a comment